NetSuite Electronic Payments- Overview

Electronic payments have become the preferred method of corporate payments due to the convenience, security, and reduction of human errors that they offer.

Using the NetSuite Electronic Bank Payments SuiteApp (formerly NetSuite Electronic Payments) you can pay vendors, deal with employee expenses, receive commissions and refunds from customers, and receive bank payments from your partners.

For corporate electronic payment needs, NetSuite provides a robust electronic bank payment functionality called Electronic Bank Payments.

Businesses can use this feature to securely automate electronic funds transfer (EFT) payments.

In the electronic banking sector, the company provides payments via EFT (including bill payments and employee expenses), refunds and payments from customers (including direct debits). There are two, free and subscription-based OneWorld version of NetSuite Electronic Payments offered to NetSuite customers.

Paying by electronic transfer eliminates paperwork, postage, and delays associated with transferring funds. In addition, you can manage reversals and partial credits, as well as large batches of payments (up to 5,000 per file).

NetSuite Electronic Payments also enables you to use Positive Pay services offered by leading banks to detect and prevent check fraud automatically.

NetSuite Electronic Payments: How It Works

Payment information is put into NetSuite’s Predefined File Format when a payment has to be processed. Once that is done, you can either import it into your bank’s software or submit it digitally.

Payees can receive email notifications when payment is processed because the payment notification feature is customizable. You can group out payments according to a variety of criteria (e.g., per vendor, per employee, etc.).

With NetSuite Electronic Payments for OneWorld, users can access more than 50 banks worldwide and create batch payments that match selected criteria automatically.

The Electronic Bank Payments SuiteApp provides the following additional features that are not provided by the standard features of Electronic Fund Transfer and Automated Clearing House (ACH) Vendor Payments:

- The generation of payment files and direct debits in the bank’s predefined format

- Standard bank payment formats supported

- Possibility of creating custom payment formats

- Batch payments for approved bills are automatically created

- Automatically approve payment batches on schedule

- Managing multiple payment batches at once

- Payment processing capabilities such as reversal and partial reversal

- Conversion of multiple currencies to make it easier to pay suppliers globally in a single payment using a single bank account

- Generating Positive Pay files that contain details of checks issued regardless of how they were produced

- Various options for selecting approved transactions for payment

Image- Benefits of adding Electronic Bank payment module for Netsuite

How to handle electronic payments in Netsuite?

NetSuite can manage several types of payments, and it includes features to manage payment processes associated with ERP systems:

1. Electronic Funds Transfer (EFT)

Electronic Funds Transfer (EFT) is the process customers use to authorize the transfer of money from their bank accounts to your bank accounts to pay their invoices.

Electronic Funds Transfer (EFT) feature of the ACH Network involves processing financial transactions using the Automated Clearing House (ACH).

Payment files can be generated for processing vendor invoices, employee expenses, commissions, refunds, and more. Reporting and reconciliation can be optimized through customized billing options, partial payments, making separate payments, and customized groups for managing bill payments.

2. Direct Debits

By using NetSuite Electronic Bank Payments, all outstanding invoices are settled through direct debit (DD) collections, making it easier for you to pay your customers’ bills.

By automating collection of customer payments, you reduce late fees, eliminate cumbersome, error-prone, and paper-filled invoicing processes, and ensure timely payment to your business.

3. Payment Management and Routing

Using the NetSuite Electronic Bank Payments module, users can create bank files for ACH payments, direct deposits, customer refunds, and other types of electronic payments. Using payment management tools, finance teams can create multiple payment batches with different criteria, protocols, and due dates. Flexible, rules-based payment aggregation reduces fraud risk by enforcing payment controls, for instance, limiting how many payments can be made per day to one vendor or employee. Electronic Bank Payments can also be used to settle outstanding invoices by withdrawing funds directly from the customer’s bank account.

Use real-time email notifications to allow multiple approvers to review a batch of payments. Depending on the urgency of the payment, payment batches can be reordered in the queue. The date or period allowed for payment reversal can also be set, which simplifies month-end reconciliation and simplifying the procedure for rolling back charges once a payment file has been created.

Payment Approvals

With automatic approval routing, payment errors are reduced and fraud has a reduced chance of occurring. Payment approvals are prompted by system-generated alerts to ensure that payment files are accurate and appropriate before initiation of payment.

Payment approval routing and email alert notifications are available for additional authorization before payments are processed, while outbound and inbound invoicing options facilitate payment tracking.

4. Worldwide Bank Support

Payments can be processed from over 50 different EFT file formats, from banks in Australia, Belgium, Italy, Japan, Canada, France, Germany, Hong Kong, Ireland, New Zealand, Singapore, Spain, United Kingdom, and the United States. For businesses that need to handle complex international transactions, multi-currency processing, a custom template, and worldwide format support are also available as options.

In addition to supporting global and local banking formats, this module supports multiple languages and multi-processing, so your team is less burdened with meeting local needs. Additionally, you can also offer your customers a range of payment options around the world.

5. Global payments

Besides supporting more than 50 international bank formats, advanced payment features support multicurrency and multilanguage capabilities.

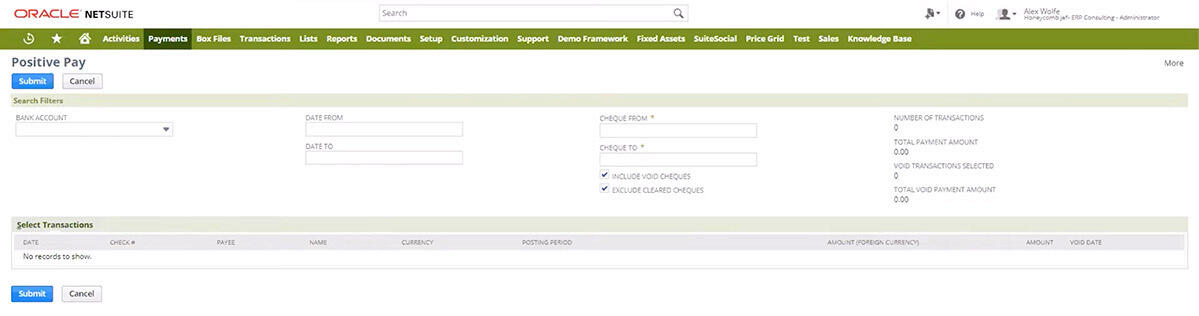

6. Positive pay

Image- Positive pay

Positive Pay, a feature of NetSuite Electronic Bank Payments, protects your bank against fraud by notifying it of the amount and payee of each check. This information can be provided to your bank before a check is presented for payment, thereby allowing the bank to confirm the check details are accurate. The bank will block these checks with the notification of a voided check.

7. Suite Tax

Electronic Bank Payments SuiteApp uses the tax information on the entity record when processing payments and generating bank payment files, depending on the payment template. SuiteTax compatibility is ensured through an update to the Payment File Template which gets the default tax registration number of the entity. SuiteTax is adding a new Bank File Template to the payment file template form as a result of the deprecation of the Bank File Template field.

8. Advanced Electronic Bank Payments License

In this application, companies and subsidiaries can send and receive payments to vendors, employees, and customers (refunds) by taking advantage of the standard templates available within their country of operation.

A license for Advanced Electronic Bank Payments is necessary to use advanced features. In Electronic Bank Payments, if your license is active, you can perform the following processes:

- Access all templates supported by the software

- Design and customize payment templates

- Automate processing of payments in batches using the Process Bills Automatically option

- Use global payment templates or customized templates to generate instant payment files.

- You can develop a suitelet using the Electronic Payments APIs

- Multi-currency payment processing is supported

- SuiteCloud Plus licenses allow you to process payment batches in parallel.

- You will not be able to perform the processes if the license client is not installed or if your license expires. Support for global payments may incur additional charges.

- Supported Payment Formats

EFT, Direct Debit, and Positive Pay transactions supported by Electronic Bank Payments can be found in the following tables and lists-

EFT Format list

S.No |

Country |

EFT Format |

Required SuiteApps |

1 |

Australia |

ABA |

|

ANZ (ANZ Bank) |

|||

ASB (ASB Bank) |

|||

BNZ (Bank of New Zealand) |

|||

2 |

Austria |

SEPA (Austria) Pain.001.001.02 |

|

SEPA Credit Transfer (Austria) |

EMEA Localization |

||

SEPA Credit Transfer (HSBC) |

|

||

3 |

Belgium |

CIRI – FBF |

EMEA Localization |

SEPA Credit Transfer (Febelfin) |

Belgium Localization |

||

SEPA Credit Transfer (ABN AMRO Bank) |

|||

SEPA Credit Transfer (HSBC) |

|||

4 |

Brazil |

CNAB240 |

|

5 |

Canada |

ACH CCD/PPD (NACHA) |

|

ACH – CTX (Free Text) (NACHA) |

|||

CPA – 005 (Royal Bank of Canada) |

|||

PNC ActivePay (PNC Bank) |

|||

6 |

Czech Republic |

ABO |

|

SEPA Credit Transfer (HSBC) |

EMEA Localization |

||

|

|

|||

France |

CFONB |

EMEA Localization |

|

SEPA Credit Transfer (ABN AMRO) |

France Localization |

||

7 |

SEPA Credit Transfer (France) |

||

SEPA Credit Transfer (HSBC) |

|||

FR International CFONB320 |

|||

FR International ISO20022 |

|||

8 |

Germany |

DTAUS |

EMEA Localization |

DTAZV |

Germany Localization |

||

SEPA Credit Transfer (Germany) |

|||

SEPA Credit Transfer (ABN AMRO Bank) |

|||

SEPA Credit Transfer (HSBC) |

|||

SEPA Credit Transfer (Austria) |

|||

9 |

Hong Kong |

HSBC ISO 20022 |

|

10 |

Hungary |

RaiffeisenDomestic Transfer (Raiffeisen Bank) |

|

11 |

Ireland |

BACS – Bank of Ireland |

EMEA Localization |

SEPA Credit Transfer (Bank of Ireland) |

Ireland Localization |

||

SEPA Credit Transfer (HSBC) |

|||

12 |

Isle of Man |

BACSTEL – IP |

|

13 |

Italy |

CBI Payments |

|

SEPA Credit Transfer (CBI) |

|||

SEPA Credit Transfer (HSBC) |

EMEA Localization |

||

|

|

|||

14 |

Japan |

Zengin |

Japan Localization |

Zengin XML |

|||

15 |

Luxembourg |

ABBL VIR 2000 |

|

SEPA Credit Transfer (Luxembourg) |

|||

SEPA Credit Transfer (ABN AMRO Bank) |

EMEA Localization |

||

SEPA Credit Transfer (HSBC) |

|

||

16 |

Malaysia |

Citibank Malaysia XML Domestic Transfer |

Southeast Asia Localization |

Citibank Malaysia XML International Transfer |

|||

Citibank Malaysia XML GIRO |

|||

Maybank Malaysia 2E–RC Domestic Transfer |

|||

Maybank Malaysia 2E–RC International Transfer |

|||

17 |

Mexico |

Banamex CitiDirect |

Mexico Localization |

Santander Mexico |

|

||

18 |

Netherlands |

Equens – Clieop |

EMEA Localization |

Equens – Clieop (ING Bank) |

Netherlands Localization |

||

SEPA Credit Transfer (ABN AMRO) |

|||

SEPA Credit Transfer (Netherlands) |

|||

SEPA Credit Transfer (HSBC) |

|||

19 |

New Zealand |

ABA |

|

ANZ (ANZ Bank) |

|||

ASB (ASB Bank) |

|||

BNZ (Bank of New Zealand) |

|||

DeskBank (WestPac Bank) |

|||

20 |

Singapore |

Citibank Singapore XML Domestic Transfer |

Southeast Asia Localization |

Citibank Singapore XML International Transfer |

|||

Citibank Singapore XML GIRO |

|||

DBS – IDEAL (DBS Bank) |

|||

DBS Singapore Ideal 3.0 Universal File Format Domestic Transfer |

|||

DBS Singapore Ideal 3.0 Universal File Format International Transfer |

|||

HSBC ISO 20022 |

|||

HSBC Singapore pain.001.001.03 Low and High Value Domestic Payments |

|||

OCBC Singapore GIRO and FAST Payments |

|||

UoB – BIB-IBG (United Overseas Bank) |

|||

UOB Singapore pain.001.001.03 GIRO, FAST and Domestic Payments |

|||

JP Morgan Singapore pain.001.001.03 Low and High Value Domestic Payments |

|||

Standard Chartered Bank Singapore iPayment CSV GIRO and Domestic Payments |

|||

21 |

South Africa |

Standard Bank |

|

22 |

Spain |

AEB – Norma 34 |

|

SEPA Credit Transfer (ABN AMRO Bank) |

EMEA Localization |

||

SEPA Credit Transfer (HSBC) |

|

||

23 |

Sweden |

Bankgiro (SEB) |

|

Plusgiro (SEB) |

|||

SEPA Credit Transfer (SEB) |

|||

24 |

United Kingdom |

BACSTEL –IP (internet service variation of BACS) |

EMEA Localization |

BACS – Albany ALBACS-IP (Albany ePAY Bureau) |

United Kingdom Localization |

||

BACS – Bank of Ireland |

|||

BACS – Bank of Scotland (Bank of Scotland PLC) |

|||

BACS (standard 18) |

|||

HSBC Faster Payments |

|||

HSBC UK CHAPS |

|||

HSBC UK BACS |

|||

HSBC BACS or Faster Payments |

|||

SVB BACS |

|||

SVB CHAPS |

|||

SEPA Credit Transfer (ABN AMRO) |

|||

SEPA Credit Transfer (HSBC) |

|||

SEPA Credit Transfer (SVB) |

|||

SVB Faster Payments |

|||

SVB BACS or Faster Payments |

|||

25 |

United States |

ACH CCD/PPD (NACHA) |

|

ACH – CTX (Free Text) (NACHA) |

|||

CPA – 005 (Royal Bank of Canada) |

|||

PNC ActivePay (PNC Bank) |

Direct Debit Format list-

S.No |

Country |

Direct Debit Format |

Required SuiteApps |

1 |

Australia |

ABA DD |

|

2 |

Germany |

DTAUS |

EMEA Localization |

SEPA Credit Transfer (Germany) |

|||

3 |

Italy |

CBI Payments |

|

SEPA Credit Transfer (CBI) |

|||

4 |

Netherlands |

SEPA Direct Debit (ABN AMRO) |

EMEA Localization |

5 |

Singapore |

DBS – IDEAL (DBS Bank) |

EMEA Localization |

UoB – BIB-IBG (United Overseas Bank) |

|||

6 |

United Kingdom |

BACS (HSBC) |

EMEA Localization |

7 |

United States |

ACH – PPD (NACHA) |

|

8 |

Belgium |

SEPA Direct Debit (ABN AMRO) |

EMEA Localization |

9 |

France |

SEPA Direct Debit (ABN AMRO) |

|

10 |

Luxembourg |

SEPA Direct Debit (ABN AMRO) |

EMEA Localization |

11 |

Spain |

SEPA Direct Debit (ABN AMRO) |

EMEA Localization |

Positive Pay Formats |

BoA/ML (Bank of America Merrill Lynch) |

RBC (Royal Bank of Canada) |

SVB – CDA (Silicon Valley Bank – Controlled Disbursement Accounts) |

International Formats |

| International Formats Available with Advanced Electronic Bank Payments |

| JP Morgan Freeform GMT 2 |

| Barclays MT103 2 |

Using Standard Payment File Formats

Payments, receivables, and Positive Pay files can all be used with the Electronic Bank Payments SuiteApp.

1. Custom Payment Templates

Electronic Bank Payments SuiteApp currently does not support customized templates for bank payment formats. A payment file template can be customized or created from scratch.

2. Multi-Currency Payments Processing

It enables you to make multi-currency payments to suppliers and employees, to refund customers in different currencies, and to receive payments in different currencies from other countries in a single payment run that uses a single bank account. Payment formats with multi-currency capabilities are necessary for multi-currency transactions.

3. SuiteCloud Plus

The purchase of a SuiteCloud Plus license can improve NetSuite performance if you are using SuiteCloud features. SuiteCloud Plus licenses increase an account’s performance by allowing more concurrent web services, scheduled processes, and file imports. SuiteCloud Plus licenses enable customers to run more web services integrations, batch processes, and file imports at the same time. SuiteCloud Plus licenses available have a direct impact on achieving throughput and scalability.

4. Automated Schedules for Payment Batches

Schedules can be set to create or approve open payment batches from a bank account automatically. It is possible to specify when batches are generated or routed for approval for each schedule. As an alternative to using payment schedules, you can submit all open batches of a bank account for approval when you submit them on the Payment Batch List.

Assign payment schedules to saved searches that are used to retrieve transactions for payment batches on company bank records.

5. Worldwide Format Support

With access to all payment templates, you can offer powerful payment processing options to overseas subsidiaries without geography limitations. Local payment formats are automatically enabled for accounts with Localization SuiteApps installed.

Key Benefits Of Netsuite Electronic Payments

The benefits of Netsuite electronic payments include improved payment processing, greater efficiency, and fewer human errors:

- Users can define criterion-driven payment batches (e.g., deadlines) and the program will create batches automatically based on those criteria.

- Streamlining workflow, minimizing delays, and reducing errors by routing approvals.

- Options include controlling bill display, partial payments, bill management, and more.

- Proactive detection of check fraud with Positive Pay anti-fraud capabilities.

- Adding e-Commerce functionality, offering payment options, improving analytics and reporting functions, and more. Integration with popular software programs.

- Payment batch queues, rollbacks, reversals with notations, and automated notifications are all options in payment management.

- Automated collection of outstanding invoices through direct debit.

- Manage all payments remotely and securely (settling client invoices and paying vendors with ease and flexibility from anywhere)

Conclusion

Companies are increasingly using EFT as a cost-effective alternative to checks. The process is faster, safer, less expensive, easier to track, and provides faster access to funds. Large transactions can be handled securely at a minimal cost using it.