As companies grow, financial requirements and reporting capabilities change. Opportunities for growth such as opening new subsidiaries, taking on vendors with different currencies, or simply a desire for more financial reporting, trigger the need for expanded financial functionality and visibility. In reality, many companies still spend countless hours manually compiling reports and performing ongoing maintenance. NetSuite multi-book accounting changes all of that with technological advancements.

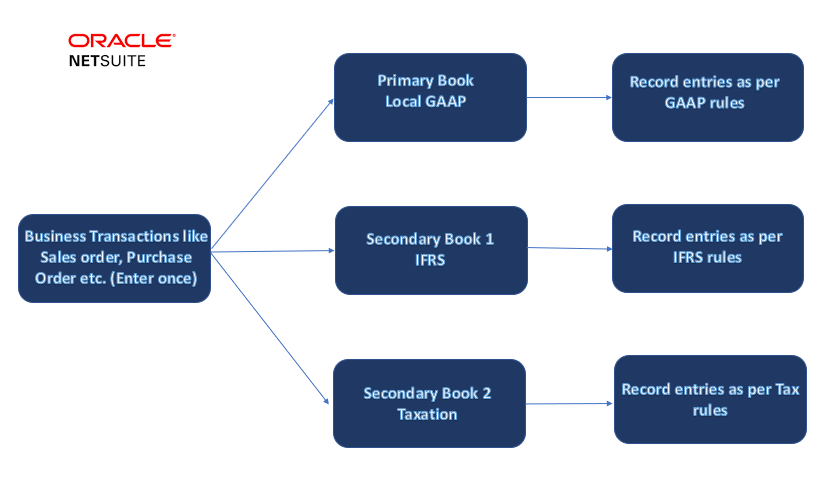

Multiple accounting books can be maintained and reported on simultaneously within NetSuite using the module. Accounting software in NetSuite is enhanced with Multi-Book. Customers can maintain up to five separate accounting books within the same ERP system by using this module. Across all accounting books, a single transaction can be recorded differently depending on the accounting rules configured in each book. Managing multiple sets of books will be easier with this module.

NetSuite Multi-Book Accounting allows companies to keep different accounting records in one place. Among other benefits, it enables you to display granular details at varying levels in real time. NetSuite Multi-Book accounting can support a wide range of managerial and compliance needs. For companies that are opening new subsidiaries, work with vendors in different currencies, need different accounting reports for local and GAAP or have various other complicated reporting needs, NetSuite Multi-Book Accounting may be the right solution for you.

Benefits of Multi Book Accounting

Video clip- Netsuite Multi book

Many finance professionals have had difficulty using Excel spreadsheets to adjust NetSuite Reporting to conform to secondary Accounting Standards such as IFRS reporting, ASC 606 retrospective reporting, or Industry specific reporting? If you fit any of these scenarios you would most likely benefit from NetSuite’s Multi-book module.

At the end of the day, you might ask yourself whether Multi-books have any actual benefits to those firms that use it. Among the benefits are:

- Provides companies with the ability to produce financial statements that meet different legal or statutory requirements. Accordingly, the Primary Book could allow reporting to be compliant with US GAAP and secondary book entries could facilitate IFRS or tax requirements.

- It enables a company to report in different currencies across different books. As an example, you may wish to report all amounts in US dollars for in-house purposes. In order to comply with International Tax requirements or to report externally, you may need to report in a base foreign currency for some of your subsidiaries. If your Primary Book specifies that the subsidiaries are based on USD, then some of those same companies can be based on CAD, EUR, GBP, etc. in your Secondary Book.

- This allows for different revenue recognition rates and expense amortization rates for different books in a company. Therefore, retrospective reporting and ASC 606 will be met. Reports can be run to compare the results from each Accounting Book.

- Consolidating the primary book and any secondary book, and removing entries between the two books, if necessary, is possible. Therefore, it will not be necessary to make manual adjustments outside of the system to obtain accurate financials for different books. NetSuite can handle all financial transactions.

- The users are able to see the book posting differences right down to the transactional level, while still maintaining security, so that unauthorized users cannot enter data into secondary books.

Multiple groups of financial records can be managed within NetSuite environments that have also implemented One-World. Multi-Book is an optional feature for NetSuite environments with One-World implemented. A finance department can instantly run financial statements tailored to the needs of their industry, country, state, or currency by simply adjusting the accounting book.

How does it work?

The Multi Book functionality in NetSuite is enabled once it has been provisioned by selecting Enable Features on the Accounting tab. An organization’s original subsidiary structure becomes its primary book as soon as it is enabled. Multiple secondary publications can be maintained in addition to the primary publication (five books in all).

With the appropriate rights, a user can create a book specific transaction (a transaction affecting only a single book) or an all-encompassing transaction that affects both books simultaneously (a book generic transaction). Both Primary and Secondary books will show the same generic transactions, with currency exchange rates added when a Subsidiary is held in a different currency.

An organization using Multi-book can set up separate transactions per book, sets up accounts, and streamlines processes such as revenue recognition, expense amortization, closing monthly, and eliminating cross-company journal entries.

The GL effect on both books can be viewed if both books are entered at the same time (book generic entries). There can be differences in currency, account, revenue recognition rules, as well as depreciation rules between books.

Multi-book Accounting Solutions: When Do You Need Them?

Multi-book accounting consists of charts of accounts, book-specific items and processes, such as expense amortization, revenue recognition, and monthly closing. Is your organization in need of a MultiBook Accounting Solution?

If you have multiple accounting books, you require a multi-book accounting system;

- Different reporting requirements for taxes.

- If your business operates in multiple time zones and locations.

- Maintaining subsidiaries.

- There are multiple accounting standards.

- Managing multiple teams in different branches, etc.

Terminologies related to Multi book accounting

Accounting for multiple books introduces some new terms to NetSuite’s vocabulary:

- Primary book: The accounting book record as it is before you enable the Multi-Book Accounting feature. When you enable multi-book accounting, the primary book becomes visible as separate from other accounting books. It is automatically configured and activated. The primary book is the daily operational book where your business transactions are recorded and viewed.

- Secondary books: Any accounting books that are not the primary book. Secondary accounting books may have one or more of these differences from the primary book: different subsidiary base currency, posting to different accounts for the same transaction, and different accounting rules.

- Book-generic: Records that are created and shared between all books. Examples of book-generic records are entity records and CRM records. Book-specific attributes may also exist for other book-general records. Examples of book-generic records with book-specific attributes are items, sales orders, sales invoices, and vendor bills.

- Book-specific: Records created specifically for one book. Book-specific records include the following:

- Book-specific journal entries and intercompany journal entries

- Revenue commitment and reclassification journal entries

- Revenue and expense allocation

- Revenue recognition and expense amortization schedules

- Fixed asset depreciation schedules and journal entries

- Chart of accounts mapping: Permits different account values to be used for transactions in secondary accounting books from those used in the primary book, thus creating different account balances and usage for the secondary book. Unless chart of accounts mapping is configured, all accounting books use the same accounts for transactions.

Journal entries for revenue recognition and expense amortization are book-specific. In the general ledger, revenue recognition journal entries debit deferred revenue and credit revenue. Expense amortization journal entries debit expense and credit deferred expense.

Multi book accounting features

1. Foreign currency management

In Multi-Book Accounting, foreign currency transactions are managed and financial reports are generated based on different base currencies assigned to respective subsidiaries. Prior to creating a secondary accounting book in Foreign Currency Management, the base currency of each subsidiary must be defined.

Book-specific transactions display the foreign currency exchange rate for the primary book. The secondary accounting book exchange rate is listed under the Accounting Books tab. A list of Accounting Books is included with book-specific transactions.

By using automatic exchange rate calculations for all books based on the stored exchange rates, Multi-Book can calculate realized and unrealized foreign currency gains/losses per transaction.

Each accounting book translates the general ledger impact of a transaction into a different base currency amount. A GL Impact of the accounting book is displayed on this page. There is an option to display all accounting books in the list.

2. Automated Accounting Rule Driven Engine

A highly responsive theme is built into NetSuite Multi-Book. Efficiencies in accounting and reporting processes are improved through reduced data entry duplication.

Multi-book accounting uses a rule-based engine. Posting activity to multiple books based on business transaction enrolment, mapping, pre-defined accounting rules and automatic enrollment. Another key feature that comes with pre-built mapping capabilities is automation. This system is highly flexible in allowing the registration of all P&L activities, GAAP entries, revenue recognition, expense amortization, depreciation, and many other activities pertaining to a single business transaction. Account charts of primary and secondary accounts can be linked.

3. Comprehensive Reporting and Analysis

Multi-Book Accounting adds a new filter called Accounting Book to standard reports that includes currency and book-specific content. Using the filter, you can select the accounting book context for the report. Active, pending, and inactive accounting books are included. All book-generic attributes displayed on book-generic transactions in both reports and searches. A different set of results may be returned based on the accounting book selected. When you run the report again, the accounting book you select in the filter will become the default accounting book.

A user’s dashboard and toolset will make it easy and fast for them to drill down into real-time answers with no need for developers or technical expertise.

Reports

The Accounting Book filter is available only for standard reports with book-specific content and currency values. The following reports are included by report category:

- Financial : A list of all reports except for Intercompany Elimination, Intercompany Reconciliation, Chart of Accounts, and Japanese

- Revenue – all reports

- Banking/Budgeting – Bank Register, Cash Statement, and Cash Statement Detail

- Time & Billables – all reports that include transactions

- Vendors/Payables – all reports

- Inventory/Items – Inventory Profitability, Inventory Valuation Summary and Detail, and Inventory Revenue Summary and Detail

- Customers/Receivables – all A/R reports

The filter is included in all custom reports. The base currency for a report, when added in the Currency: Base Currency column, means the accounting book currency for the subsidiary.

4. Comprehensive Customizations

NetSuite Multi-Book accounting enables automated and customized accounting processes. It simplifies the creation of custom forms, workflows, and records. In addition, it creates a mapping environment for different business processes.

A powerful scripting functionality is integrated into the system, which ensures the alignment of the system as a whole. Suitecloud has expertise in providing customization for multiple books.

Final words

Every business needs a customized solution that matches their evolving needs and functional well-being. Regardless of these criteria, NetSuite works to attain business success with NetSuite features and provides active solutions periodically. In addition to improving reporting, this solution reduces the need for error-prone manual adjustments. An enterprise can optimize financial close processes, comply with governmental regulations, achieve real-time visibility, and manage financials effectively with NetSuite multibook accounting.