A company’s financial management is its backbone. An organization’s ability to function well depends on it. Using financial management systems, a company’s financial activities can be thoroughly planned, coordinated, controlled, managed, and monitored to increase profits. In addition, it requires the procurement of funds and their efficient use. The responsibility of financial management includes handling all aspects of account and payment management, risk management, etc.

For accounting departments to be able to utilize financial records efficiently and to increase business growth, they require essential tools. NetSuite’s Advanced Financial Management offers complimentary services. Software for expense allocation, amortization, statistical accounts, better budget management, flexible billing management, and reporting etc. This all-in-one solution streamlines key business and financial processes.

Planning budgets and managing expenses is easy with NetSuite Advanced Financials. Furthermore, it facilitates the billing process for the finance department, reducing the difficulties of billing.

NetSuite advanced financials offers time-saving and productivity-boosting features. Billing and budgeting can be taken care of in one place with NetSuite. With the ability to customize your billing schedule and track how your spending compares to your budget, NetSuite advanced financials is an indispensable tool for growing businesses.

With Oracle NetSuite Advanced Financials, you can more effectively plan your budget, manage costs, and provide customers with hassle-free flexible billing. Additionally, NetSuite Advanced Financials includes statistical account functionality for reporting both monetary and non-monetary values.

Video clip on- NetSuite Advanced Financials

What are the key benefits of Advanced Financials?

- Real-time visibility into budgets- It gives you a clear picture on budget’s in real-time without any complications and confusions.

- Automate expense allocation and amortization to improve productivity – Automating expense allocation and amortization speeds up processing, saving your team’s time and effort which automatically results in increased and improved productivity.

- Utilize statistical accounts to calculate dynamic allocations- Using the allocation schedules functionality, it uses the balance information from the statistical account to determine how expense allocations are too performed.

- Multiple budgets can be managed- It allows users to easily compare multiple budgets and create new budgets based on existing ones.

- A real-time comparison between budget and actual is possible- Real-time comparison of budget statement and actual spending is possible with it.

- Assign expenses to GL accounts, classes, departments, and locations- By using weighted formulas, users are able to allocate expenses based on the desired parameters without assigning them to a specific department, location.

- Connect amortization schedules to bills, bill credits, projects, and more- Easy to plan out and streamline expenses with amortizations schedules.

The Advanced Financial Management Features- That Increase Visibility of your Financial Operations

Financial management solution entails planning, organizing, directing, and controlling an organization’s financial activities, including obtaining funding and utilizing it. To maximize the financial gains of an organization, management principles are applied to financial resources.

In NetSuite’s Advanced Financials module, users can keep track of expenses and stay on top of budgets with a range of features. Advanced Financials can help finance departments streamline billing processes and eliminate the need for manual labor. NetSuite Advanced Financials offers the following main features:

Image- Advanced Financials from NetSuite

1. Budget Management and Reporting

Budget management and reporting are used by finance teams to evaluate the actual spending against the allocated budget. Keeping track of expense reports and controlling budgets is easier with NetSuite Advanced Financial management platform. Finance professionals can enter budgets, create new plans based on existing solutions, or import figures from Excel with ease using one intuitive interface.

It is possible to set up multiple budgets for the same project, while reports illustrate how the reality compares to your plans with the multiple budgets feature. Seeing how your budget compares to your actual spending as you go along allows you to make adjustments as you go along.

- Tracks your budget and helps you follow up.

- Easy entry of budget for accounts thanks to a single interface.

- You can make a copy of an existing budget or import an existing budget from an Excel spreadsheet using the Copy Budget feature.

- Excel can be used to create a budget, which can be exported through CSV.

- You can simplify budgeting by using multiple budgeting features. Multiple budgets can be created and managed simultaneously.

- Estimates the income and expense of a budget as well as shows a comparison between the budget and actual.

2. Expense allocations

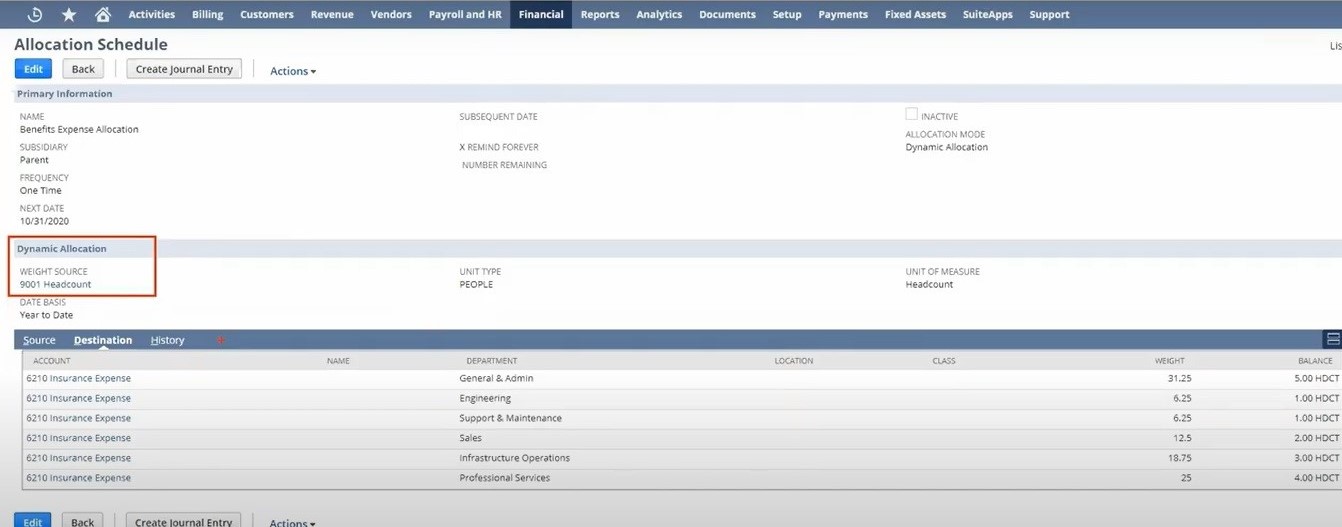

Image- Expense allocation

The module’s billing management features allow users to control revenue-based recurring billing processes. It lets you bill customers on a one-time or recurring basis and manage payment terms. With integrated revenue functionality, it is simple to combine billing schedules with many types of sales, such as plans that require an initial payment amount.

Indirect expenses are necessary for accurate accounting and determining the total cost of an object. Expenses such as labor, rent, utilities, office supplies, etc., can be accounted for in financial statements to estimate total costs.

Save time and let your team focus on what really matters. Automating expense distribution and allocation allows finance teams to focus on improving and saving. Using the Allocation feature you can enter expenses without assigning them to a specific location or department, and then later allocate them according to a weighted formula.

- You can run the Allocation Schedule once or on a regular basis.

- Dashboard Reminders let you know when to process active allocation schedules.

- After reviewing, you can click to create a journal entry for your schedule.

3. Amortization schedules

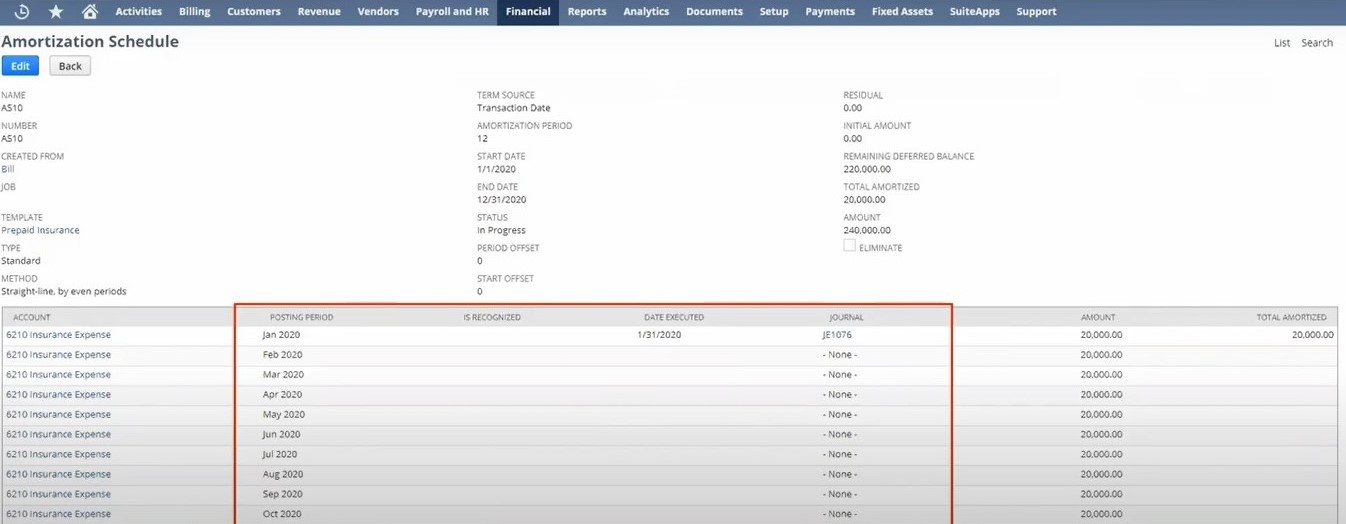

Image- Amortization schedule

Automated amortization schedules can be created in the software to help streamline processes such as amortizations of prepaid expenses. Planning is easy with Amortization Scheduler, which allows payments, credit card purchases, and job spending to be planned.

Furthermore, you can set up your spending to be amortized according to percent completion of each job.

Amortization of expenses helps distribute an intangible asset’s costs over its useful life. Assets that are intangible are not present physically, for example. Trademarks, patents, copyrights, etc. They are non-resalable. As a result of this distribution of costs, the remaining balance of the asset decreases over time. As a result, the book value of intangible assets is slowly reduced.

- Businesses can automate amortization schedules with NetSuite software.

- Amortization schedules on jobs can be linked with it. As the percentage of the job is completed, expenses are amortized accordingly.

4. Statistical accounts

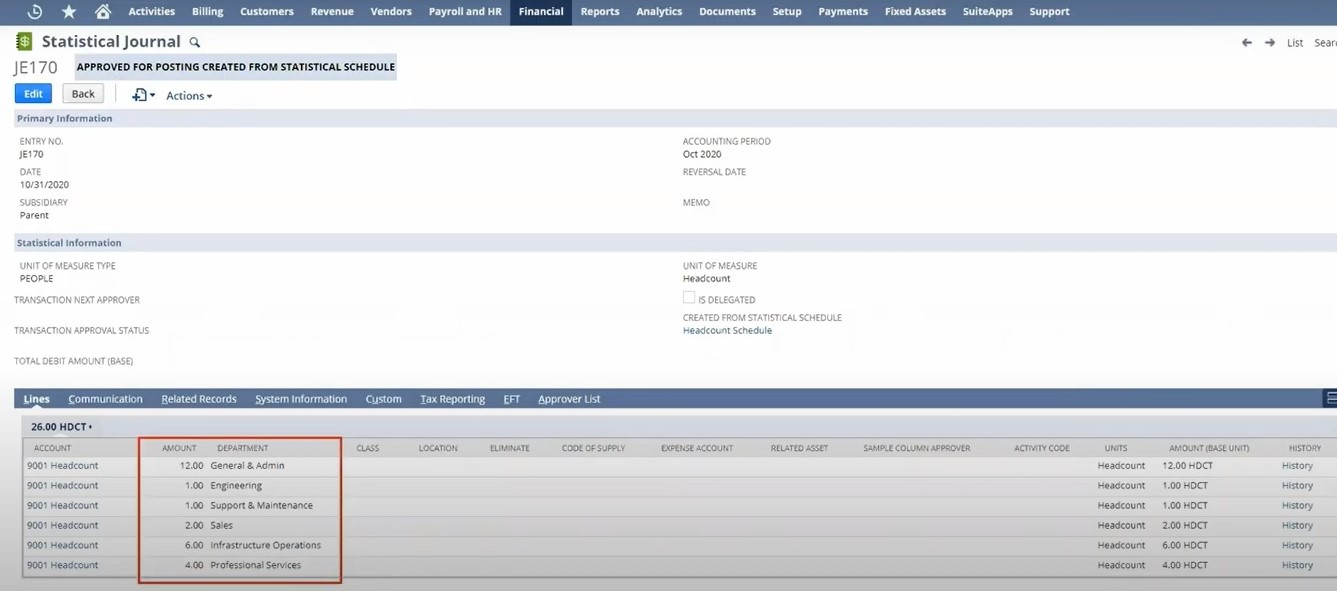

Image- Statistical journal

NetSuite’s Advanced Financial module contains statistical accounts. People who maintain accounting, close periods, make journal entries, allocate costs and revenues, and create financial reports are typically using these accounts. NetSuite’s statistical accounts are typically used by management to gain valuable real-time insight that might otherwise be lost.

With NetSuite’s statistical accounts feature, your finance department is able to track non-monetary data in the form of accounts in your ledger. Those accounts can also be used for expense allocation schedules.

- Finance teams are able to track critical non-monetary data and values through the Statistical Accounts feature of Advanced Financial. The information is then used in reports and income statements.

- NetSuite automatically allocates financial activity across your business based on various factors.

- Automates allocation of non-monetary costs of the business, such as overhead, rent, etc.

- Executes multiple allocation schedules successively.

5. Advance billing management

Image- Billing management

The billing process can also be streamlined using NetSuite Advanced Financials. With integrated billing, commissions and sales forecasts, a clearer picture of future finances can be given and budgeting and planning can be more accurate. Flexible billing schedules can also be configured based on line items on sales orders. Customers can easily edit their own billing plans, payment method, and demographic information using self-service capabilities.

Businesses generally charge their customers for their products or services on a regular basis (quarterly, yearly, or monthly).

- Advanced Billing automates the generation of invoices and provides customized billing schedules.

- It enables users to manage the billing process entirely on their own. Billing can be done both on a one-time basis and on a recurring basis.

- The application allows you to bill your customers on different terms, such as charging them in advance or splitting the charges for a period.

- It’s easy to set up billing schedules with integrated revenue recognition functionality. The system lets you generate invoices for a variety of sales, such as instalment billing plans or billings that require advanced payment.

- Billing schedules can be changed at any time. Billing cycles may apply to the entire order or to each item. Creating a billing schedule on a sales order is convenient for users.

- Billing schedules and sales forecasts can be integrated with advanced billing management. Billing schedules can be adapted to spread your upcoming bills over a period.

- Clients can even manage their information, individual billing plans and payment options through the easy self-service facility.

- With the Incentive Management module you can link billing schedules to sales commissions and forecasts to gain a better understanding of future expenses.

Perks of implementing Advanced Financial management software to Businesses

Financial management tools enable businesses to make informed decisions regardless of the challenges they face. Due to Covid-19’s unpredictability, businesses had to adapt quickly in order to survive. Based on Gartner’s 2021 Magic Quadrant , NetSuite’s financial management suite continues to rank among the top of its competitors in integrated financial planning and analysis.

- Budgets can be tracked and compared in real-time with actuals to ensure they do not spiral out of control

- Automation of key processes reduces time spent on manual tasks and errors, improving productivity.

- Multiple budget records can be managed, including department, project, location, or item. Enhances financial controls and visibility.

- Automate the billing process to save time.

- Increase productivity by automating expense allocation and amortization.