In the financial advisory business, client trust is everything. However, managing thousands of client relationships while maintaining high service standards is no small feat, especially when operations are heavily manual.

A leading Mumbai-based mutual fund advisory firm, with a growing portfolio of over ₹3,000 crore across 5,000+ investor families, found itself at a critical juncture. With ambitions to scale further, they realized that their existing processes could not support their growth trajectory. What they needed was a digital transformation, one that would bring efficiency, transparency, and personalization to their client interactions.

Their journey with Zoho CX Suite is a case study in how the right technology, when mapped to the right processes, can drive both operational excellence and superior client experiences.

The Business Landscape: High Touch, High Volume

The firm operates in a niche space where financial advice is deeply personalized, yet processes like onboarding, KYC, SIP tracking, and client servicing involve high volumes of routine, repetitive tasks. Before the Zoho implementation, the teams relied on a patchwork of spreadsheets, email trails, and phone calls to manage operations.

This led to several operational bottlenecks:

Client data was scattered across multiple files and systems, making it difficult to get a consolidated view of any investor.

KYC document collection and verification were handled manually, often involving back-and-forth emails and delayed follow-ups.

SIP renewals and investment reminders were dependent on human tracking, leading to missed deadlines and lapses.

Client servicing lacked a formal ticketing system, making issue tracking and SLA enforcement virtually impossible.

Management had limited visibility into the team’s productivity or the overall health of client relationships.

The firm realized that if they wanted to deliver the level of service their clients expected, while scaling their operations — they needed a unified, automated system that could streamline workflows and provide real-time visibility.

The Solution: Zoho Suite as the Digital Backbone

After evaluating multiple CRM platforms, the firm chose Zoho CX Suite for its flexibility, integration capabilities, and cost-effectiveness. The objective was clear: bring the entire client engagement lifecycle — from lead acquisition to onboarding, servicing, and relationship management — onto a single platform.

The Zoho CX Suite implementation focused on four core applications:

Zoho CRM – For centralized client data management and workflow automation.

Zoho Desk – For structured client servicing with SLA-driven ticketing.

Zoho Campaigns – For automating routine client communications.

Zoho SalesIQ – For real-time website chat support linked with CRM data.

The Implementation Journey: Process-Driven Digitalization

Phase 1: Deep-Dive Process Mapping

Before configuring the system, a detailed discovery phase was conducted involving workshops with the advisory, compliance, and support teams. The goal was to map out every step of the client lifecycle:

Lead capture and qualification

KYC documentation and onboarding

Portfolio tracking and transaction updates

SIP renewal cycles

Client service requests and issue resolutions

This groundwork ensured that the CRM configuration was aligned with real-world operations, not just software features.

Phase 2: Zoho CRM Customization & Automation

The CRM was customized with modules specific to the mutual fund advisory business:

Investor KYC Tracker: A checklist-driven workflow that tracked document submission, verification status, and escalations.

Portfolio Management Module: Capturing folio-wise details of all mutual fund holdings, SIPs, and transaction history.

Task Automation: Tasks were automatically created for KYC follow-ups, SIP renewals, and document expirations, ensuring no manual tracking was needed.

Approval Workflows: Multi-level approval processes were configured for onboarding new investors and high-value transactions.

Phase 3: Structured Client Support with Zoho Desk

A service desk environment was set up to ensure all client queries were formally logged, tracked, and resolved:

Tickets were automatically assigned based on query type (e.g., account statements, SIP clarifications).

SLA-based alerts ensured that no ticket remained unattended beyond the allowed time.

The team built an internal Knowledge Base for handling common client FAQs, reducing repetitive query resolutions.

Every support interaction was linked back to the client’s CRM profile, maintaining a unified communication log.

Phase 4: Client Communication Automation via Zoho Campaigns

One of the major inefficiencies was the manual effort required in sending routine communications. With Zoho Campaigns:

SIP renewal alerts were fully automated based on maturity dates captured in CRM.

Investment performance updates were sent on a periodic schedule.

Relationship communication, such as birthday greetings and milestone acknowledgments, were automated with personalization tokens.

The marketing team used CRM segmentation to target specific client groups based on investment patterns or risk profiles.

Phase 5: Live Chat Integration with Zoho SalesIQ

Given the firm’s expanding digital footprint, they integrated Zoho SalesIQ to enable real-time client interactions via their website.

Clients could initiate chats for instant clarifications.

All chat transcripts were automatically synced with the CRM, enriching client profiles with conversation history.

If a chat couldn’t resolve the query, it was escalated into a service ticket within Zoho Desk.

Phase 6: Training & Adoption Strategy

Understanding that technology adoption could be a challenge, the implementation included:

Team-specific training workshops.

Simplified SOP manuals for daily operations.

Power users identified within the team to act as adoption champions.

A phased rollout approach, starting with a pilot group before expanding firm-wide.

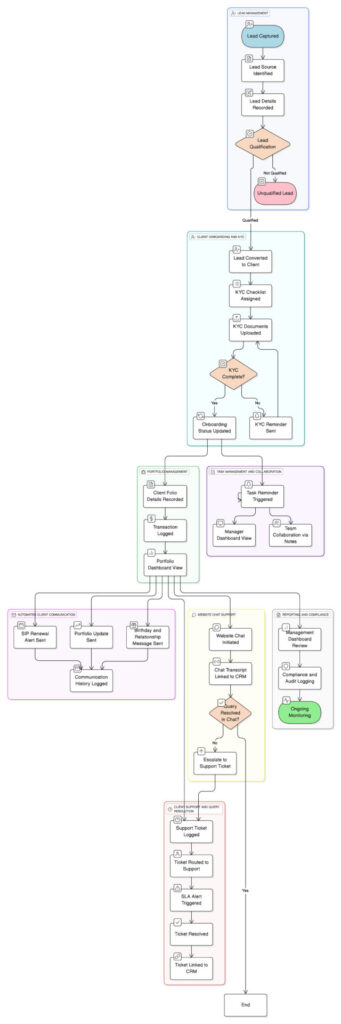

Overall Process Flow Using Zoho CX Suite:

Business Impact: Quantifiable Gains and Qualitative Improvements

The transformation was visible within weeks of going live. Some of the key outcomes included:

40% reduction in client onboarding time, thanks to KYC workflow automation and centralized document tracking.

60% automation of SIP renewal communications, ensuring no manual tracking or missed follow-ups.

Client service response time reduced from 24 hours to under 6 hours, with SLA-based ticket management.

Enhanced visibility for the management team, with CRM dashboards providing real-time insights into client lifecycle statuses, pending tasks, and team productivity.

Stronger audit-readiness, with every client interaction, document, and transaction formally recorded and traceable.

Strategic Takeaways

For financial advisory firms, the challenge isn’t just managing large volumes of clients it’s doing so while maintaining personalized, high-touch relationships. The firm’s adoption of the Zoho CX Suite demonstrates that scalable growth and personal client care aren’t mutually exclusive. With the right digital backbone:

Manual tasks get automated.

Client-facing teams spend more time advising, less time tracking.

Service quality becomes measurable, predictable, and consistent.

The Road Ahead

With the core CX Suite in place, the firm now plans to deepen its digital capabilities by:

Implementing Zoho Analytics for in-depth portfolio performance dashboards.

Automating compliance workflows, including document e-signatures and audit trails.

Exploring AI-driven client insights and intelligent recommendations through Zia AI.